*Above is our interactive gold price chart where you can view the current price of gold or historical price data.

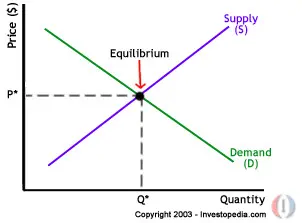

For those looking at jumping into the gold market, some confusion often attends the term, “gold spot price.” In short, the gold spot price represents the price at which physical gold can be bought and sold at a specified time and place. A myriad of factors go into determining this price including market forces such as supply and demand, as well as options, futures, and prevailing bid and ask prices. The gold spot price is calculated based on the average bid prices put forth by professional traders on the worldwide gold market. If investors are looking at entering the gold bullion market, it behooves them to get a firm grasp of the dynamics of spot gold pricing.

Where Gold Spot Prices Originate From

As in most industries, the big movers and shakers have an outsized impact on the market, and these industry shapers are clustered at three specific exchanges. The London Gold Fixing, the New York Mercantile Exchange (NYMEX), and the Commodities Exchange (COMEX), which is a division of the NYMEX whose province is specifically that of trading metals like gold, silver, copper, and aluminum.

London Fix Gold Prices

The London Gold Fix historically “fixed” the price of gold beginning in 1919. At the time, the setting of the price was conducted at the banking concern of N.M. Rothschild & Sons, but has since been conducted by a secured, dedicated line since Rothschild exited the precious metal trading industry in 2004 with the sale of their interest to Barclays. This technological move to a secured line was in recognition of the fact that many banks have moved to the outskirts of London proper owing to real estate realities.

The fixing board is composed of market makers in the banking industry that includes Barclays, Scotia-Mocatta, HSBC, and Société Générale. Additionally, to sit on the fixing board, each bank must also be a member of the London Bullion Market Association. Conducted twice daily, at 10:30 AM and 3:00 PM London time, with the exception of Christmas Eve and New Year’s Eve. While nominally structured to establish prices for contracts between members of the London Bullion Market, their pricing provides a recognized benchmark for gold prices around the globe.

The process of “fixing” the price is somewhat convoluted with each of the participating backs, which not only owns gold for their own trading portfolios, but also serves as brokerage firms for their clients looking to invest in precious metals themselves. The lead participating bank initiates the pricing by quoting a price that is close to the previous gold spot price. Each bank simulates the effect of that price on gold trading looking at stocks of physical bullion inventory along with future trading contracts, or paper gold that can have a destabilizing effect on physical gold prices.

New York Mercantile Exchange (NYMEX) Gold Prices

The New York Mercantile Exchange traces its origins in the 19th-century dairy industry as businesses began to organize exchanges to manage their local markets more efficiently. After running through an assortment of trade association and names, the New York Mercantile Exchange was formed in 1882, and today is the United State’s premier commodities exchange with a worldwide impact on the exchange of everything from energy products to valuable trade metals like gold.

COMEX Gold Prices

The COMEX division manages the metals side of their operation. Specializing in futures contracts, the COMEX is the go-to place for investors looking to throw their speculative hat into the precious metal future trade. Owing to the paper nature of the trades, the prices reflected on the COMEX are significantly lower than for those of physical gold. This allows for investors of all sizes to dabble in the precious metal market.

Additionally, delivery of the gold is neither typical nor expected. Indeed, large investment firms are looking to sell their futures prior to the settlement date in anticipation of yielding a profit against the short-term gamble of holding the paper.

Factors that Determine Gold Spot Price

As with any commodity, a myriad of factors can influence the price. Owing to the historical significance of gold, political, economic, and social factors can also play into the value of the gold spot price. Additionally, supply, demand, and size of transactions all play a role in pushing gold prices upwards or downwards dependent on the capricious nature of world events.

For instance, according to the dictates of economies of scale, the larger the transaction, the cheaper the cost of investing in the item, so while the gold spot price represents the cost of a single Troy ounce of gold, larger sales volumes can well determine a lower buy-in cost for the skilled investor.

Gold-Silver Ratio

The Gold-Silver Ratio is a leading indicator as to whether or not it is a good time to buy gold at a given point and time. In short, the gold to silver ratio is the amount of silver it takes to buy one ounce of gold. Currently, the 75:1 ratio listed on the exchanges means that 75 ounces of silver will be needed to purchase an ounce of gold. This ratio is arrived at by taking the daily gold spot price and dividing it by the price of silver to arrive at a comparison.

Investors scanning this rate base their buying/selling decisions on the size of the ratio. A high ratio suggests that it is a good time to buy silver, while a lower ratio indicates that it is a propitious time to invest in gold. Owing to the fact that the silver to gold ratio can fluctuate so dramatically, attempting to nail down a firm indication is somewhat akin to trying to nail Jell-O into ice. That being said, experienced investors look at a wildly fluctuating ratio as a strong indicator that it is time to diversify their portfolio for maximum financial security.

As with all investment opportunities, buyers need to do their homework prior to entering the market. Gold holds a historic fascination on the human consciousness, and that assures that it will remain a strong force for investors looking to hedge their bet in these uncertain economic times.

Buying Physical Gold Bullion

Once a buying decision has been reached, most investors actually purchase their bullion through certified dealers. Buying gold in this manner has some inherent benefits. Most notably, investors can make purchases of smaller denominations, typically in 1 oz gold bars, from leading dealers who procure their gold stocks directly from leading national and private mints.

Such products are shipped with assay information that delivers the investor peace of mind knowing that they are taking delivery of what was advertised. Moreover, these third party gold bullion dealers have instituted state of the art tracking systems that assures you that you will know where your shipment is along every stretch of its delivery path.

Gold Bullion Prices

Clearly, if investors are looking at making a purchase of gold, the price of that product is determined on the conference line of such banking luminaries as Barclays and others, and pushed and pulled by the prevailing market forces that normally dictate supply and demand of available commodities. For more than a millennium, gold has been the trading medium of choice and that has not changed. What has changed is the ready availability of instant information about the volatile whip-saw price changes, and the best ways for investors to capitalize on that data.

As an investor, when you are looking to purchase physical gold bullion, you will notice that the bullion is listed above the current gold spot price. This spread between the spot price and the product’s sell price is referred to in the industry as a premium. As with products in other industries you can compare gold prices and find the lowest over-spot premium on all products.